President Joe Biden visited Congress on Thursday to present a new low-cost social spending package, valued at about $ 1.75 trillion, with which he hopes to win the support of the moderate and progressive wings of the Democratic Party.

The plan maintains the investments in climate and early childhood education that were foreseen in the initial project of 3.5 billion dollars but leaves out the guarantee of a family and maternity leave paid at the national level and chills the expectations of a regularization plan for undocumented immigrants.

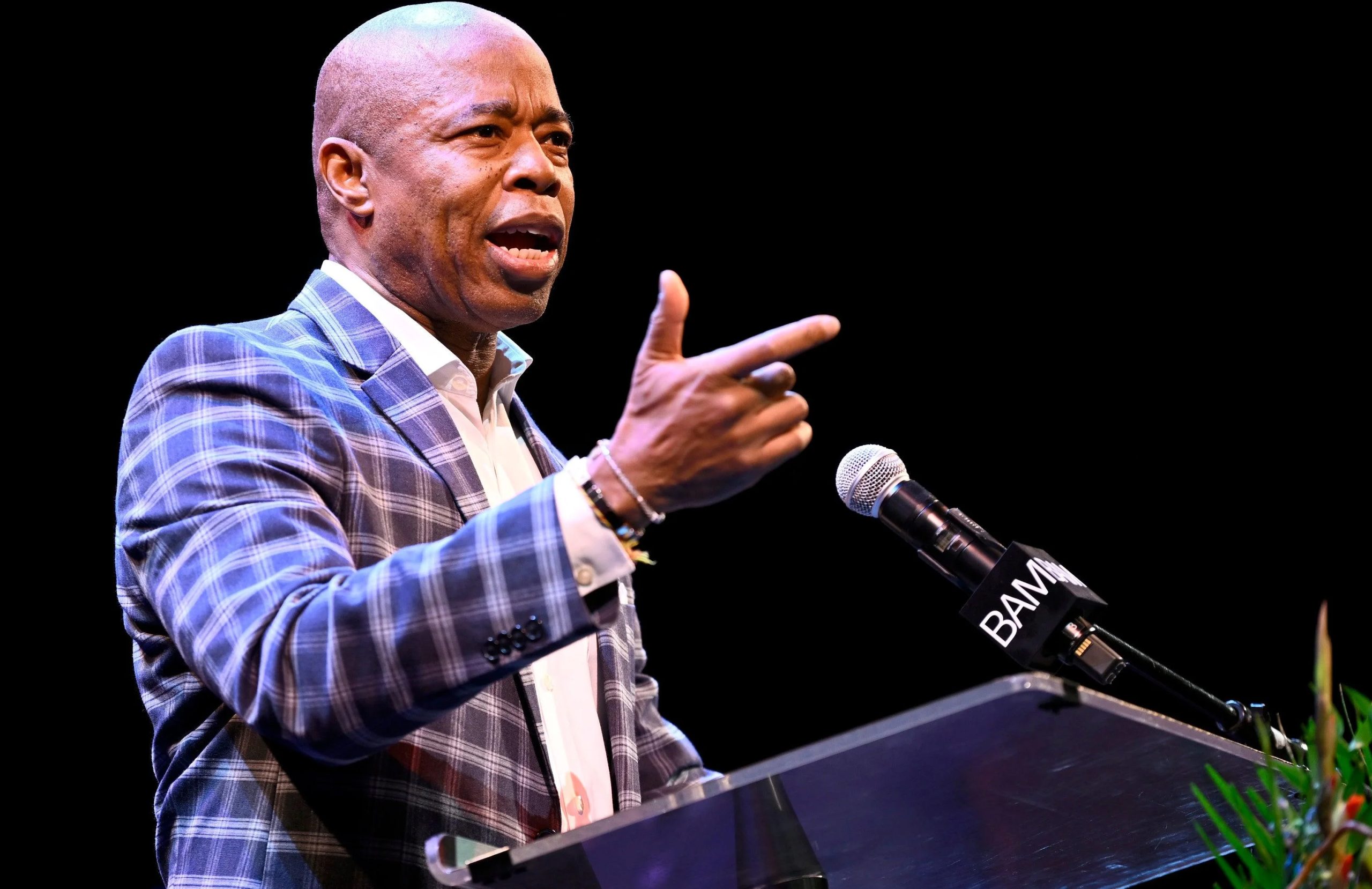

“Everyone agrees with this,” Biden told reporters when he arrived in Congress this morning to meet with Democrats, in an attempt to reach an agreement with them before leaving on a few hours’ trips to Rome to participate. at the summit of the G20.

However, Democratic Senator Dick Durbin told reporters there is “a lot of uncertainty” about whether the new plan will succeed in uniting the party’s factions, and it remains to be seen whether the progressive wing will accept a bill that cuts planned social spending in half. originally.

The package, announced this Thursday by the White House, maintains an investment of 555,000 million dollars in the fight against the climate crisis, mainly through fiscal incentives for the use of clean energy sources.

Another 400,000 million will be allocated to free education for children between 3 and 4 years old, the two years before entering primary school; and a further $ 200 billion will allow tax credits to be extended for lower-income Americans with children for another year.

It also includes investments in health insurance and affordable housing for low-income people but leaves out a key pillar of what had been Biden’s agenda, the guarantee of paid maternity or paternity leave, a right that in the United States. It is not guaranteed at the federal level.

The White House plan leaves the door open to add another 100,000 million dollars that would go to immigration, but everything indicates that they would go to visa expenses and not to the regularization of millions of undocumented, as the Democrats initially wanted.

The financing of Biden’s spending plan is based on the imposition of a 15% tax for large companies, within the global agreement of an international minimum tax on multinationals.

It also increases taxes by 5% for people with incomes greater than 10 million dollars; and an additional 3% for those over 25 million dollars.

On the other hand, it penalizes the repurchase of shares by large companies with 1%, a mechanism used to raise the price of assets.

Finally, the proposal to tax billionaires, who earn more than 100 million dollars a year or whose assets are valued at more than a billion dollars, and which would have affected tycoons like Elon Musk or Jeff Bezos, is left out.