The digital music sector has doubled in recent years and will double again in the next five, predicts in an interview the Spaniard Jerónimo Folgueira, the CEO of Deezer, who does not exclude purchases from rivals or even an IPO.

Paris-based Deezer is the second-largest independent digital music platform by subscribers, behind only Spotify. Apart are those linked to the three technological giants (Apple, Google, and Amazon). And it is the leader in catalog volume, with 90 million titles.

The company closed in 2021 with 10.5 million subscribers and some 400 million euros in revenue, almost doubling the figures from five years earlier. Deezer does not disclose its profit or loss, nor does it disclose its subscriber retention rate, although its manager says they are “very loyal”.

Folgueira even aspires to “triple” the volume of the company in the next five years, greatly improving the forecasts of several market studies that predict that the digital music market will double again in that period.

“The growth of the industry has been spectacular in recent years,” he anticipates, before predicting that he sees “quite likely” that developed countries will end up having as many digital music subscriptions as mobile phone lines.

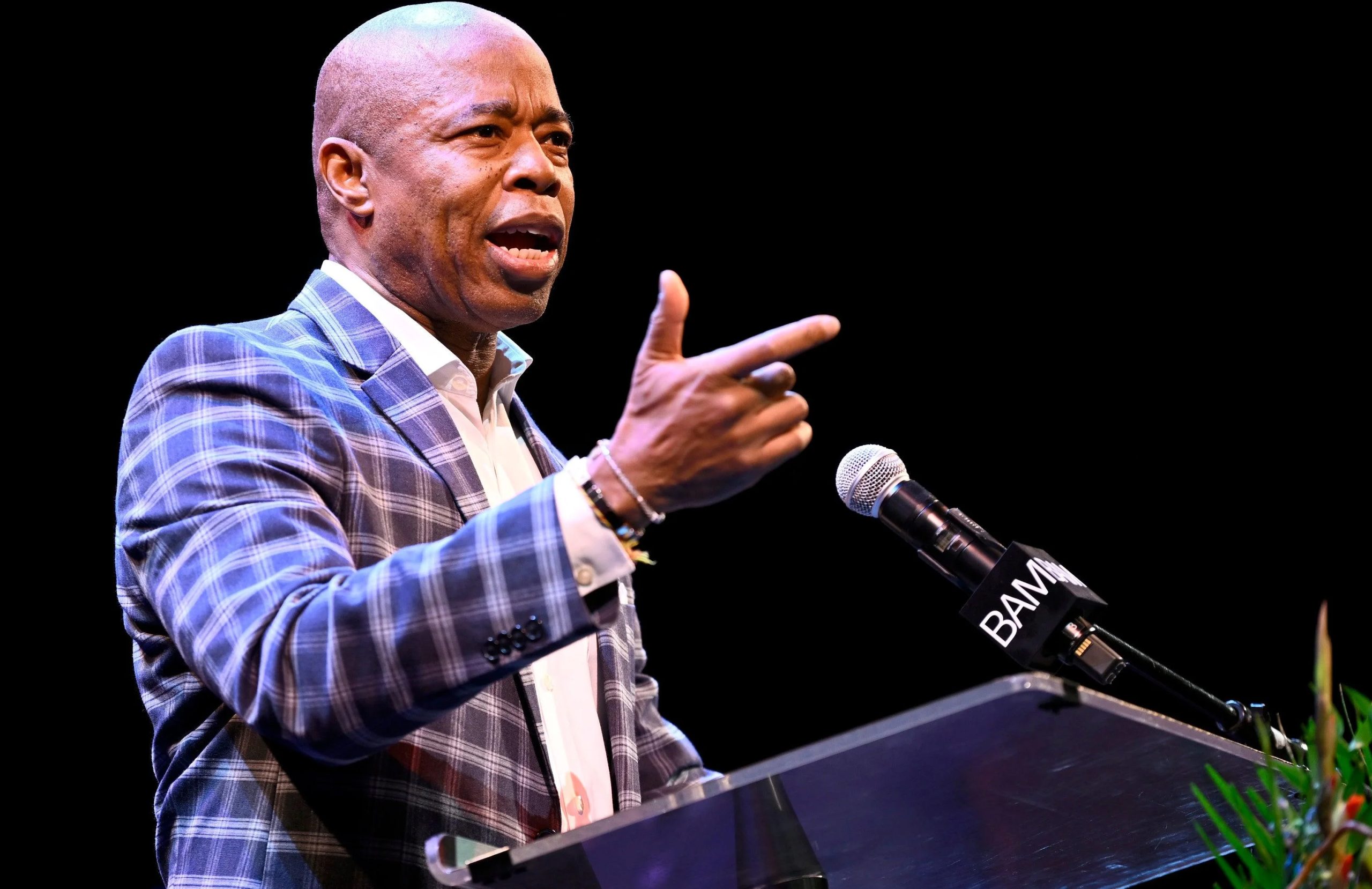

This young executive, barely 40 years old and who works without a suit or tie, details how “people consume much more music than before, and adjusted for inflation, they have never been paid as little as now.”

For example, the company he runs offers high-fidelity access to its entire catalog for 9.99 euros per month, which is half (adjusted for inflation) of what consumers spent on CDs in the 1990s. ensures.

Folgueira joined Deezer at the end of May 2021 from Germany’s Spark Networks, and his tenure as CEO was marked by buyouts to increase the company’s volume, culminating in a New York IPO.

Now, the Spanish director does not rule out doing the same with Deezer to make the most of the explosion that is coming in the sector: “We need to enter new markets and there are opportunities to grow through purchases, it is an option that is on the table”.

If the case is presented, he is convinced that the company, whose shareholders include the French telecommunications operator Orange, has “the financial muscle” to carry them out.

With Spotify and the three tech giants out of his league, he’s eyeing some of the smaller, “niche” companies with inroads into sound quality as possible targets.

And later he does not rule out an eventual IPO. “I think Deezer is ready, then there is the question of when is the right time,” he explains from his office, next to the electric guitar that he likes to strum, although he regrets that he does not have many talents for it.

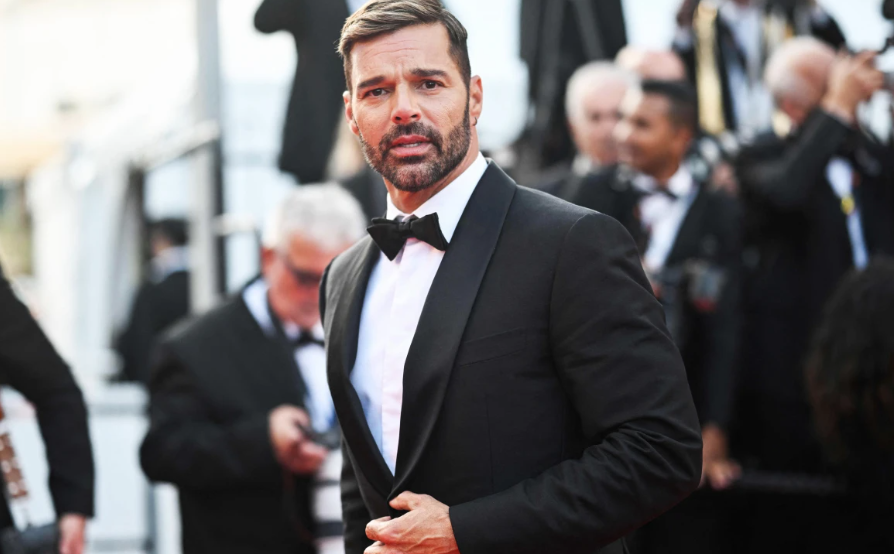

News about the digital music industry has gone around the world in recent weeks due to the march by Spotify of several artists, led by Canadian Neil Young, in protest against the Joe Rogan podcast, in which it has been broadcast anti-vaccine content.

Folgueira points directly to the rival firm: “When you pay Joe Rogan 100 million dollars (for his podcast), what he says you are financing.”

He emphasizes that Deezer “has no place” for hate content or content that offers disinformation, although he insists that they give less importance to content that is not musical. “We want to be the house of music,” he says.

He also assures that in recent weeks they have noticed an increase in subscribers in markets such as the United States, Canada, or the United Kingdom, possibly due to this issue.

Born in Argentina, of Spanish parents, although he grew up essentially in Pamplona after a short stint in Logroño, Folgueira has always worked in technology outside of Spain and speaks enthusiastically about the future of this industry.

Deezer currently has a very important market penetration in France (almost a third) or Brazil (close to 20%), although in the US it barely has 1% and is exploring “all kinds of alternatives” to settle in that market.

At a global level, the proportion of the population with digital music subscriptions remains low (25% in the US), and Folgueira sees a strong increase, whether through podcasts, audiobooks, live concert broadcasts, or the possibilities of web 3.0, such as selling NFTs or bringing music to the metaverse.

“You have to take music wherever you are”, he summarizes, and believes that this will boost the market: “Penetration is still very low. There is a lot of room to continue increasing subscribers”.