The Commerce Department reported that the expansion in the last quarter of the year was 1.7%, despite the inconveniences created by the Omicron variant of the coronavirus. Shares in the main Wall Street indices are trading higher minutes after the opening

The US economy grew 1.7% in the last three months of 2021, the Commerce Department announced Thursday.

The figure, adjusted for inflation, reflects growth in gross domestic product, the broadest measure of goods and services produced. On an annualized basis, the quarter’s increase was 6.9%.

For the full year, economic expansion was 5.7%, the largest since 1984, also reflecting the depth of the damage inflicted by the coronavirus the year before.

After the publication of these data, the main Wall Street indices rose minutes after the opening on Thursday. At 14:35 GMT, the Nasdaq was up 2.38%, the Dow Jones was up 0.82% and the S&P 500 was up 0.89%.

Also, consumption by households, which make up nearly three-quarters of the US economy, rose 7.9% last year.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/PU64NXLI6FBMXLE6JBSOMPYNDQ.jpg%20420w) Workers on a car assembly line, in a file photograph. EPA/JEFF KOWALSKY

Workers on a car assembly line, in a file photograph. EPA/JEFF KOWALSKYStrong fourth-quarter growth was fueled in part by consumer spending, which “primarily reflected an increase in services, led by health care, leisure, and transportation,” the Commerce Department reported. Private investment was also an important factor.

Consumer spending and private investment picked up quickly as a result of advances in the vaccination campaign, cheap credit terms, and additional rounds of federal aid to households and businesses.

Squeezed by inflation and COVID-19, the US economy is expected to slow this year. Experts have lowered their forecasts for the current January-March quarter, reflecting the impact of the Omicron variant. For the full year 2022, the International Monetary Fund has forecast that the country’s GDP growth will slow to 4%.

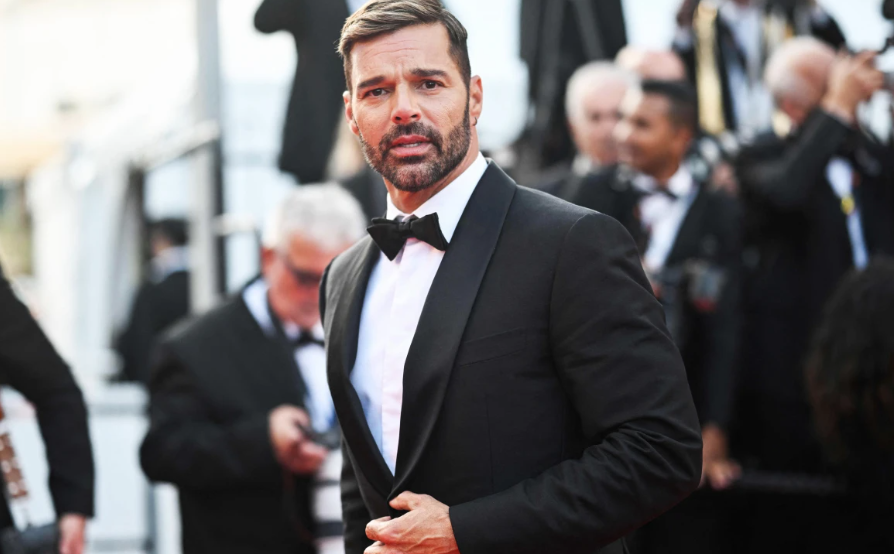

Separately, the Federal Reserve signaled on Wednesday that it plans to start raising its benchmark interest rate as soon as March, a key step in reversing its pandemic-era low-rate policies that have fueled hiring and spending. growth, but also inflation.

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/BGJELNHTIQOFJT4KI3FMPW37EQ.jpg%20420w) US Federal Reserve Chairman Jerome Powell speaks at an online press conference from the Federal Reserve Building in Washington, the United States, on Jan. 26, 2022. US Federal Reserve Board/Handout via REUTERS

US Federal Reserve Chairman Jerome Powell speaks at an online press conference from the Federal Reserve Building in Washington, the United States, on Jan. 26, 2022. US Federal Reserve Board/Handout via REUTERSThe US central bank has also decided to continue to reduce the monthly rate of bond purchases and plans to eliminate it completely in early March.

In its statement at the end of its two-day meeting, the institution chaired by Jerome Powell indicated that as of February it will only buy bonds worth 30,000 million dollars, after having gradually reduced this figure from 120,000 million monthly.

The Fed stressed that job creation in recent months has been “ solid ” and that unemployment has fallen “ substantially ”, but that inflation remains high due to “imbalances between supply and demand related to the pandemic and the reopening of the economy.